How Does Medicare Work For People Who Have Retired?

May 26, 2025 By Kelly Walker

To those who qualify, the government offers the Medicare health insurance program. Those with end-stage renal illness, those who are 65 or older, and those who are under 65 but have specific limitations are eligible. Those who have paid into the Medicare system during their working years and are now retired are eligible for Medicare benefits. A supplement to Original Medicare that includes services including vision, dental, and hearing, Medicare Advantage is one of Medicare's four pillars. Part D pays for medically necessary medications. Medicare helps pay for a lot of medical treatment but doesn't pay for everything. Copayments, deductibles, and coinsurance may all be the individual's responsibility. To help with this, private insurance firms provide Medigap plans as a supplement to Medicare.

Medicare Eligibility After Retirement

Once you retire, you can apply for Medicare if you meet the following criteria:

Age Requirement

To qualify for Medicare, you must be 65 or older. Having a disability, though, may make you eligible for Medicare benefits at an earlier age.

Citizenship Or Legal Residency

It would be best to be a citizen or legal resident of the United States and a resident of the country continuously for the past five years to qualify for Medicare.

Work History

To qualify for Medicare in retirement, you or your spouse must have paid into the system for at least ten years. Part B premiums may apply if you do not have the necessary job history but are otherwise eligible for Medicare coverage.

Medicare Enrollment After Retirement

Initial Enrollment Period

Your Introductory Enrollment Period (IEP) begins three months well before month you turn 65 and ends the month you reach that age. You will be registered in Medicare Parts A and B during your IEP if you receive Social Security benefits.

Generic Enrollment Period

Medicare enrollment is possible year-round during the IEP and the General Enrollment Period (January 1–March 31). Nevertheless, coverage will not begin until July 1 if you enroll during the General Enrollment Period.

Special Enrollment Period

If you missed your Initial Enrollment Period or the Regular Enrollment Period (SEP), Medicare enrollment during a Special Enrollment Period might be possible. If you obtain insurance via your workplace or another source that meets specific requirements, you may be eligible for a Section 125 SEP.

Coverage Options After Retirement

Several Medicare plans are available after retirement. Among these possibilities are the following:

Original Medicare

Original Medicare is composed of two parts: Part A (medical insurance) & Part B (health insurance) (medical insurance). The federal government provides healthcare coverage through Original Medicare, which includes hospitalization, physician services, and medical supplies.

Medicare Advantage

Part C of Medicare, often known as Medicare Advantage, is provided by private insurance firms with Medicare agreements to do so. In addition to the services offered by Original Medicare, additional benefits like prescription medication coverage, vision care, & dental care are also included.

Costs Of Medicare After Retirement

Medicare has several post-retirement expenses. These expenses consist of the following:

Premiums

Those who, or whose spouses, have worked and paid Medicare taxes do not need to pay a premium for Part A. Part A of Medicare, however, may cost a bonus if you do not have the necessary job history. Income-based monthly premiums are charged for Medicare Part B.

Deductibles

Before Medicare starts paying for your healthcare expenses, you must first pay the Part A and then the Part B deductible. Deductibles are subject to annual adjustment.

Copayments And Coinsurance

Copayments or coinsurance may still apply after you've paid your deductible. Copayments are a predetermined percentage of the total cost of medical services. In the case of medical care, coinsurance means that you will be responsible for paying a fixed rate of the total bill.

Conclusion

Those 65 or older, incapacitated, or suffering from end-stage renal illness rely heavily on the healthcare services provided by Medicare. Medicare provides health insurance to retirees who have worked and paid Medicare taxes for at least ten years. Medicare pays for inpatient stays, outpatient care, and prescription medication. Copayments, deductibles, and coinsurance may be required out of pocket in addition to what Medicare pays. To help with this, private insurance firms provide Medigap plans as a supplement to Medicare. Individuals should know their Medicare coverage options and the various Medicare sections to make educated healthcare selections. Medicare enrolling during the initial enrollment period is also recommended to avoid paying a late penalty.

Share Repurchases vs. Redemptions: Pros and Cons

Learn about the pros and cons of share repurchases and redemptions for companies and shareholders. Discover the benefits and drawbacks of each method.

May 26, 2025 Kelly Walker

Brownfield Investment: An Overview of Pros and Cons

A brownfield investment occurs when a company or government agency purchases or licenses old manufacturing facilities to initiate a novel industrial activity. Discover more about it in this article!

May 26, 2025 Rick Novak

Using the Producer Price Index (PPI) to Predict Inflation

Learn how to predict inflation using the Producer Price Index (PPI). Also, learn the basics of the PPI, how it is calculated, and how it can be used to make informed financial decisions

May 26, 2025 Kelly Walker

Corporate Tax Rates Around the World: From the Highest to the Lowest

Here are the nations that have the most favorable business tax environments and which impose the highest tax burdens on corporations. Whether you're an entrepreneur looking to minimize your tax liabilities or simply curious about global tax policies, this article provides valuable insights into the world of corporate taxation.

May 26, 2025 Kelly Walker

Multiple Linear Regression (MLR) - An Introduction to the Formula and Its Application

Learn what Multiple Linear Regression (MLR) is and how it can be used to analyze relationships between multiple independent variables and a dependent variable. Also, learn the practical applications of MLR, particularly in finance.

May 26, 2025 Kelly Walker

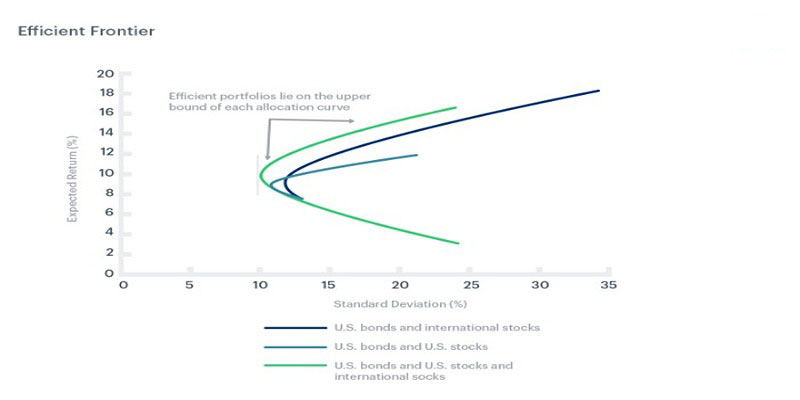

What Is the Efficient Frontier?

Dive into the fundamentals of the efficient frontier and learn how its elements work together for maximum potential gains with minimal risk. Find out all you need to know about it in this helpful blog post!

May 26, 2025 Rick Novak